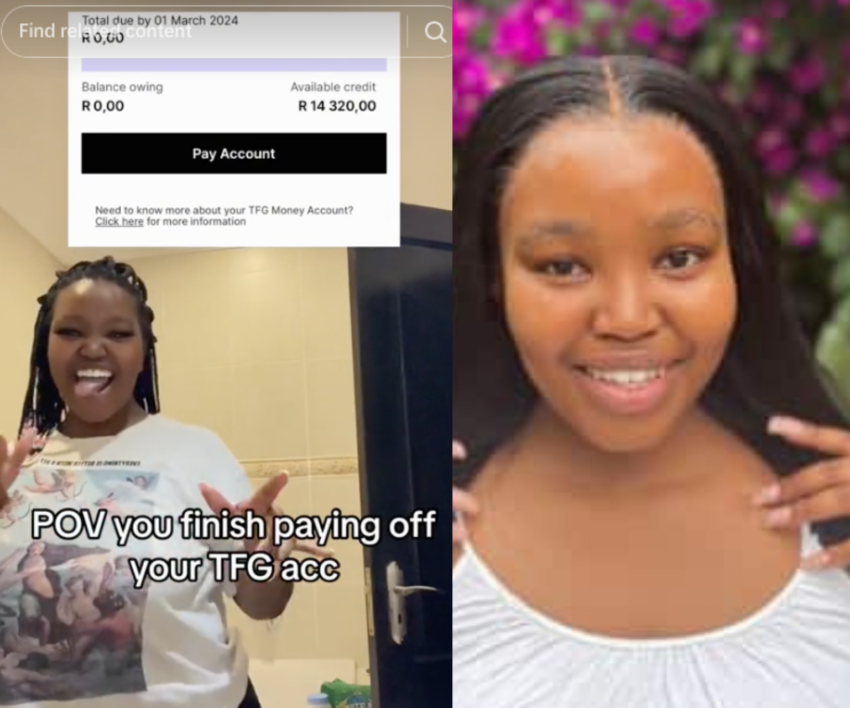

A TikTok creator with the username @bartsimpsonlefttoe celebrated paying off her R14k debt from a clothing company.

Clothing stores usually give customers who meet the requirements for a clothing account a limited credit where the customer can purchase clothes and pay them later. If paid properly the interest rate will decrease.

South Africans have come to realize that maintaining clothing accounts requires financial discipline, as failure to pay on time can result in a poor credit score, which can have negative consequences when applying for loans, such as a home or car loan.

Therefore, it is crucial to ensure timely payments to avoid any hindrance to your financial goals.

The creator whose real name is Noni, posted a video of her dancing with a screenshot of her account balance at zero. The video gained thousands of views with users shocked at how much she owed.

@bartsimpsonlefttoe #CapCut#tiktoksouthafrica#mzansitiktok#fyp ♬ original sound – Masego🤍

Many users took to the comment section to ask for advice on how to increase their credit and how to avoid having their accounts in arrears.

The creator made a follow-up video explaining what led to her R14,000 debt saying that she had to discipline herself by spending money on clothes she could afford in order to lower her monthly interest rates.

@bartsimpsonlefttoe Replying to @soyeah very important to know that interest rate is hectic!! Only spend what u can afford and afford to pay!#tiktoksouthafrica#mzansitiktok#fyp#foschini ♬ original sound – Noni❤️✨

One user commented: “Lapho I want to open it to increase my credit score, ithin iadvice?”

A TikToker user commented: “Lapho I can’t pay R1200 yabo,” adding a crying emoji.

Another user responded to the creator’s follow-up video saying, “I switched off the automatic credit increase …I think that’s where people get stuck. They need to ask me before increasing my credit limit. This helps with the discipline you’re talking about.”

Also see: WATCH: Student shares budget plans for R7000 NSFAS allowance