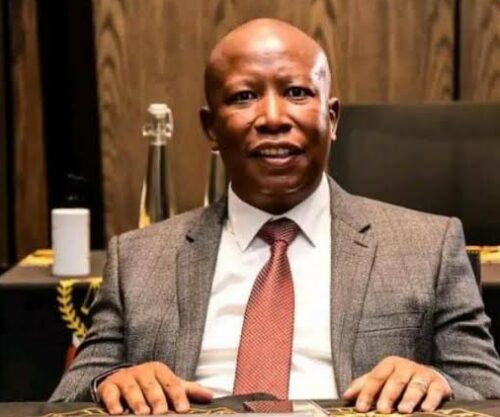

The High Court in Pretoria has sentenced former Venda Building Society (VBS) Mutual Bank chairperson Tshifhiwa Matodzi to 495 years in prison for his involvement in one of South Africa’s largest banking scandals.

According to The Citizen, Tshifhiwa pleaded guilty to all 33 charges, including fraud, theft, money laundering, and corruption, and entered into a plea agreement with the state.

Despite being sentenced to 15 years for each count, the court ordered that the sentences for counts 2 to 33 run concurrently with count 1. This means Tshifhiwa will serve an effective 15 years in prison. Additionally, he was declared unfit to possess a firearm.

Tshifhiwa was the primary accused in the case, which involved the looting of nearly R2.3 billion from VBS Mutual Bank and falsifying the bank’s 2017 financial statements to conceal its insolvency.

The above-mentioned publication mentions that in October 2020, former VBS executive Philip Truter made a deal with the state, pleaded guilty to all charges, and is now serving a 7-year sentence.

The latest arrests occurred in March, with the suspects appearing in the Giyani Magistrate’s Court. Risimati Hitler Maluleke was granted bail of R25 000, while Nditshedzeni Mashau and Zwivhuya Goodness Tshishonge were each released on R20 000 bail.

Hawks have arrested at least 33 suspects related to the VBS scandal.

Additionally, VBS Mutual Bank states on its website that VBS was placed into final liquidation by the North Gauteng High Court on 13 November 2018, with Mr Anoosh Rooplal appointed as liquidator. According to the Insolvency Act 24 of 1936, the liquidator’s primary role is to trace and recover the Bank’s assets for the benefit of all known creditors.

Also see: Internet compare Nigerian designers with SA designers after Durban July