The drought, the unstable Rand, rising food prices, petrol prices and interest rate hikes has left us all with a lot less money at the end of the month . It’s then not surprising that cash-strapped South Africans are searching for solutions online, especially when it comes to cars.

What are South Africans searching for when it comes to finance?

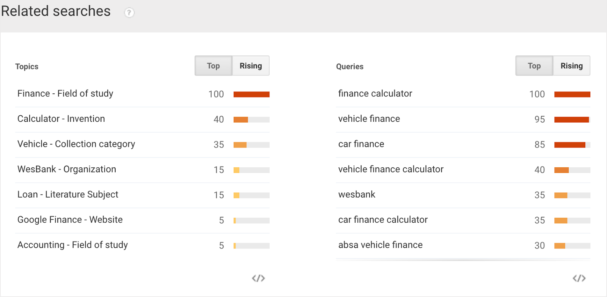

A look at Google search trends over the past 30 days shows a consistent interest in ‘finance’ as a general search term. Drill down into terms related to the main topic, and you’ll find rising interest in the terms ‘finance calculator’, ‘vehicle finance’ and ‘car finance’.

South Africans are looking to buy vehicles and want to know what they can afford to drive. While new and used vehicle sales continue to decline, for the first time since 2009, demand for used vehicles now outstrips new vehicles.

I’m looking to buy a car. Where do I start?

3 Things to know before buying a car

1. Know your car finance terms

Monthly instalments. Linked or fixed interest rates. Deposits. Insurance. Balloon payments. These are terms that can confuse or simply stand in the way of a buyer getting their new car. Make sure you make the best decisions by understanding these terms in our car finance term guide.

2. Let your budget do the driving